Do you have a family business? Well, you are not alone. In fact, family businesses play a significant role in the economy, comprising around 90% of US businesses. These family-run firms range from small-scale sole proprietorships to massive public companies like Walmart, Ford, Mars, Home Depot, and Marriott, where 35% of the Fortune 500 are family owned. Approximately 17 million family businesses in the US contribute to 64% of the US GDP and employ 62% of the US workforce, fostering job creation and economic growth.

One striking statistic shows that family-controlled businesses in the S&P 500 have an annual return on investment (ROI) 6.65% higher than non-family firms. This highlights the advantage of a family-driven business model, which brings its own unique strengths and values. Furthermore, the growth of women-owned family businesses has increased by 37% in the last five years, indicating a shift towards greater diversity and inclusion within these enterprises.

Family businesses often pride themselves on their ethical standards, with 60% of owners believing theirs are higher than their competition. Trust, integrity, and a sense of responsibility run throughout their operations, resulting in long-standing relationships with customers and suppliers.

Challenges

Family-owned businesses face certain challenges despite their success and influence, especially regarding succession planning. Seventy-eight million Baby Boomers are now reaching retirement age, with 12,000 retiring each day, and the median family business leader around 60That means a significant generational transfer is imminent. Surprisingly, while 70% of family business owners want their children to inherit their business, only 30% successfully transition it to the second generation. Just 12% remain viable in the third generation, and a mere 3% continue into the fourth generation and beyond.

One probable reason for this decline is the reluctance of the younger generation, particularly Millennials, to take over traditional family businesses and the increasing preference for starting new enterprises. It is crucial to address this succession challenge to ensure the continuity and growth of family-controlled firms.

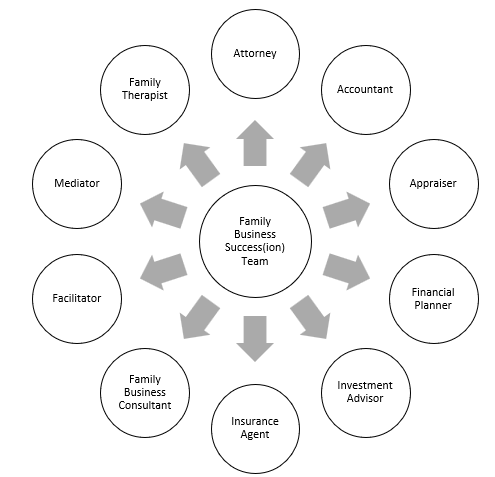

For this reason, a successful family business requires a team of professionals with diverse expertise and perspectives. This support system helps owners navigate the complexities of succession planning, retirement, financial planning, asset management, and so forth.

Roles and Responsibilities

| Specialty | Role on the Team | Area of Focus |

|---|---|---|

| Attorney | Draft documents | Risk mitigation |

| Accountant | Tax planning | Decreasing tax exposure |

| Appraiser | Value assets | FMV and discounts |

| Financial Planner | Retirement planning | Investing for retirement |

| Investment Advisor | Asset management | Portfolio design |

| Insurance Agent | Assess insurance needs | Cash needed in future |

| Family Business Consultant | Designing succession plan | Family relationships |

| Facilitator | Facilitate family meetings | Communication skills |

| Mediator | Address family/role conflict | Conflict resolution |

| Family Therapist | Work with family members | Healthy relationships |

Attorneys play a valuable role in drafting legal documents that mitigate risks and protect the interests of the business and the family. Their focus is on maintaining the continuity of the business while minimizing any potential legal issues that may arise.

Accountants provide tax planning services to assist in navigating tax regulations, identify opportunities to minimize tax outlay, optimize the business’s financial situation, and ensure compliance with tax laws.

Appraisers play a critical role in determining the value of assets within a business. They provide a fair market value (FMV) assessment, considering applicable discounts or valuation methodologies to ensure transparency and accuracy regarding issues like estate planning and passing assets to the next generation.

Financial planners assist family business owners with planning for retirement by developing strategies to invest and grow assets. This ensures financial security and a smooth transition into retirement.

Investment advisors specialize in managing business assets and designing portfolios that align with the owner’s long-term goals to provide reliable financial returns for the business.

Insurance agents assess the insurance needs of family businesses, considering factors such as succession planning, potential cash requirements in the future, and risk management. These steps will help protect the business and its owners from unforeseen events.

Family business consultants assist with designing succession plans that focus not only on the financial aspects but also on maintaining healthy family relationships throughout the process, ensuring smooth transitions.

Facilitators oversee family meetings, ensuring effective communication and collaboration. Their role is particularly important when discussing sensitive topics such as succession, ownership, and decision-making.

Mediators have the skills and experience to mediate disputes, find common ground, and promote healthy resolutions. They can step in to address family conflicts that may arise during the succession planning process.

Family therapists work closely with family members, providing support and guidance to maintain healthy relationships within the family and the business, especially during complex times like transitions.

Family business success(ion) is indeed a team sport. While these organizations contribute significantly to the economy, challenges such as succession planning threaten their continuity. By involving professionals from various fields to assist with overcoming such challenges, we can ensure a smooth transition so that family businesses can thrive and impact future generations.

Tim Figley, of Teamswork and a trusted Family Business Consultant, brings his expertise to help businesses thrive and families succeed. To access additional valuable resources, visit timothyfigley.com today.